Fidelity Brochure

Fidelity Brochure - We’ll develop a personalized investment strategy designed to. Learn more about building a successful retirement, saving for retirement, and setting your retirement goals. A companion piece for the shareholder worksheet. This brochure is designed to give you an overview of potential retirement risks, and then help you create a diversified income plan to help you meet them. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic estimate of anticipated expenses and sources of income. Compare the available income annuity options and select the. The fidelity advisor simple ira allows you to save toward your retirement goals each time you get paid. Fidelity advisor 529 offering statement [pdf] 6 fidelity investments create a disciplined investing plan. What you won’t find everywhere is a proven. Fidelity advisor 529 offering statement [pdf] 2a brochure (the “program brochure”) from march 28, 2024, through march 31, 2025. What you won’t find everywhere is a proven. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic estimate of anticipated expenses and sources of income. Fidelity® personalized planning & advice is a professionally managed account service built around your personal situation. 6 fidelity investments create a disciplined investing plan. Building a plan with the appropriate level of risk and being responsible for its ongoing management can be. • you determine how much you want to have automatically deducted from each. The fidelity advisor simple ira allows you to save toward your retirement goals each time you get paid. We’ll develop a personalized investment strategy designed to. Clients and prospective clients can obtain a copy of this program brochure without charge by calling. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic estimate of anticipated expenses and sources of income. A companion piece for the shareholder worksheet. Meet client investing goals with help from fidelity model portfolios and our lineup of. Fidelity’s online tools can help you answer questions like: Fidelity advisor 529 offering statement [pdf] 6 fidelity investments create a disciplined investing plan. 2a brochure (the “program brochure”) from march 28, 2024, through march 31, 2025. Learn more about building a successful retirement, saving for retirement, and setting your retirement goals. The fidelity advisor simple ira allows you to save toward your retirement goals each time you get paid. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic estimate of anticipated expenses and sources of income. Fidelity’s online tools can help you answer questions like: A companion piece for the shareholder worksheet. This brochure highlights. 2a brochure (the “program brochure”) from march 28, 2024, through march 31, 2025. We’ll develop a personalized investment strategy designed to. Building a plan with the appropriate level of risk and being responsible for its ongoing management can be. Let’s face it—all home warranty companies offer similar coverage, at a similar cost. This brochure highlights important differences between the brokerage. We’ll develop a personalized investment strategy designed to. This brochure highlights important differences between the brokerage and investment advisory services that may be provided to you as part of your relationship with fidelity investments. Fidelity’s online tools can help you answer questions like: Covers five key risks in retirement and explains how a financial representative can help build a retirement. Compare the available income annuity options and select the. The fidelity advisor simple ira allows you to save toward your retirement goals each time you get paid. Fidelity’s online tools can help you answer questions like: • you determine how much you want to have automatically deducted from each. Learn more about building a successful retirement, saving for retirement, and. Compare the available income annuity options and select the. • you determine how much you want to have automatically deducted from each. Meet client investing goals with help from fidelity model portfolios and our lineup of proven funds and etfs. This brochure highlights important differences between the brokerage and investment advisory services that may be provided to you as part. Enables you to invest in a broad range of funds available through fidelity and fundsnetwork® mutual fund brokerage services, depending on the guidelines set by your employer and noted. What you won’t find everywhere is a proven. We’ll develop a personalized investment strategy designed to. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic. Learn more about building a successful retirement, saving for retirement, and setting your retirement goals. At fidelity, we believe everyone should have a retirement income plan that incorporates a realistic estimate of anticipated expenses and sources of income. Let’s face it—all home warranty companies offer similar coverage, at a similar cost. Building a plan with the appropriate level of risk. Meet client investing goals with help from fidelity model portfolios and our lineup of proven funds and etfs. Let’s face it—all home warranty companies offer similar coverage, at a similar cost. We’ll develop a personalized investment strategy designed to. 2a brochure (the “program brochure”) from march 28, 2024, through march 31, 2025. What you won’t find everywhere is a proven. Fidelity advisor 529 offering statement [pdf] Clients and prospective clients can obtain a copy of this program brochure without charge by calling. A companion piece for the shareholder worksheet. Compare the available income annuity options and select the. We’ll develop a personalized investment strategy designed to. Fidelity investments offers clearing and custody services, investment and technology products and solutions, brokerage and trading services, and a range of insights, expertise, and world. 2a brochure (the “program brochure”) from march 28, 2024, through march 31, 2025. Learn more about building a successful retirement, saving for retirement, and setting your retirement goals. Meet client investing goals with help from fidelity model portfolios and our lineup of proven funds and etfs. Enjoy peace of mind with a fidelity warranty services vehicle protection plan, knowing that you are covered anywhere in the u.s., its territories or possessions, or canada. The fidelity advisor simple ira allows you to save toward your retirement goals each time you get paid. 6 fidelity investments create a disciplined investing plan. This brochure highlights important differences between the brokerage and investment advisory services that may be provided to you as part of your relationship with fidelity investments. What you won’t find everywhere is a proven. Enables you to invest in a broad range of funds available through fidelity and fundsnetwork® mutual fund brokerage services, depending on the guidelines set by your employer and noted. This brochure is designed to give you an overview of potential retirement risks, and then help you create a diversified income plan to help you meet them.Fidelity Bank Brochure, Flyer, Pamplets, SignBoard, Billboar Freelancer

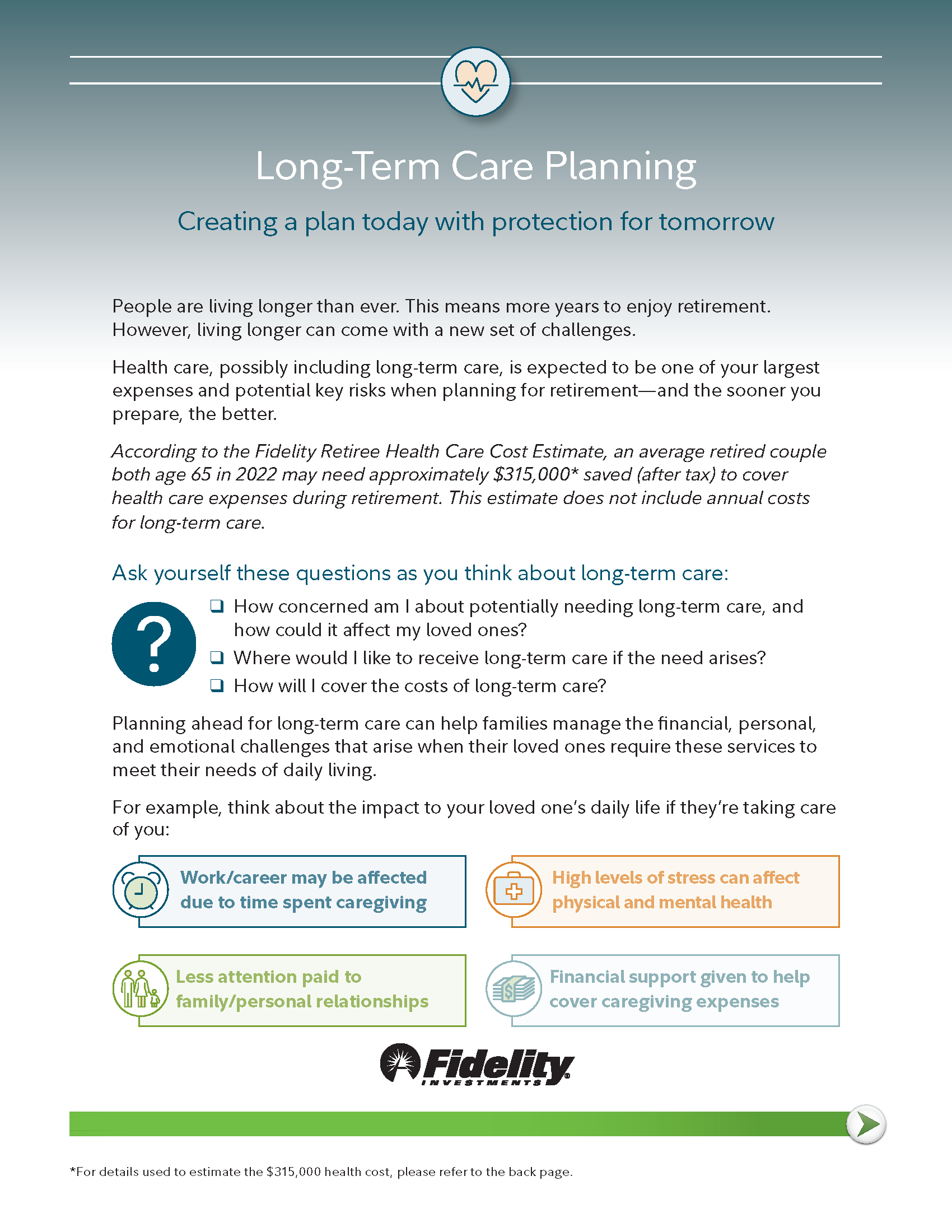

Longterm care planning Fidelity

Fidelity Bank Brochure, Flyer, Pamplets, SignBoard, Billboar Freelancer

Fidelity Bank Brochure, Flyer, Pamplets, SignBoard, Billboar Freelancer

Fidelity Bank Rupp Marketing

Independent Review of the Fidelity Investment Life Insurance Company

Fidelity Planviewer App Brochure PDF Mobile App Ios

Fidelity BrokerageLink Brochure by The MJ Companies Issuu

Brochure American Fidelity PDF PDF

Fidelity Investments M&T & Co

Let’s Face It—All Home Warranty Companies Offer Similar Coverage, At A Similar Cost.

Building A Plan With The Appropriate Level Of Risk And Being Responsible For Its Ongoing Management Can Be.

Covers Five Key Risks In Retirement And Explains How A Financial Representative Can Help Build A Retirement Income Plan;

At Fidelity, We Believe Everyone Should Have A Retirement Income Plan That Incorporates A Realistic Estimate Of Anticipated Expenses And Sources Of Income.

Related Post: